Cigarette Tax Stamps: An Effective Tool for Controlling Tobacco Consumption

Cigarette tax stamps are an important measure adopted by governments to regulate the tobacco market, increase tax revenue, and reduce the harm caused by tobacco. As a symbol of the legality of tobacco products, tax stamps not only serve an economic function but are also closely tied to public health policies. As global tobacco consumption continues to rise, countries have been using cigarette taxation and the implementation of tax stamp policies to tackle this challenge, curb smoking rates, and improve health outcomes.

1. The Functions and Significance of Cigarette Tax Stamps

Cigarette tax stamps, typically affixed to each cigarette pack, indicate that the product has paid the necessary taxes. The main functions of tax stamps include:

- Promoting Public Health: Through high taxation, tax stamps help curb tobacco consumption, which in turn lowers the incidence of smoking-related diseases.

- Anti-counterfeiting and anti-counterfeiting: Tax invoices usually have anti-counterfeiting technology (such as laser marking, invisible coding, QR code, etc.)

- Price control: Tax invoices record the tax costs of products, which helps stabilize tobacco market prices and avoid vicious competition.

2. International Tax Stamp Systems

Different countries have tailored their cigarette tax stamp systems according to their policy goals and economic needs. For example:

- China: In China, cigarette tax stamps not only signify tax payment but also feature unique designs and anti-counterfeiting marks to ensure that consumers can identify genuine products. Tax stamps play a particularly important role in reducing the flow of illegal cigarettes in the market.

- United States: In the U.S., cigarette tax stamps are regulated by both federal and state governments. Different states may have different tax stamp designs and rates, but all aim to manage tobacco products effectively. In states with high tax rates, tax stamps are a critical tool to prevent cigarette smuggling.

- European Union: EU countries generally implement strict tobacco taxation policies, with tax stamps serving as a key tool to ensure that tobacco products comply with health regulations and tax requirements. Tax stamps in the EU often include prominent anti-counterfeiting features to ensure consumers are purchasing legal products.

3. Challenges Facing Cigarette Tax Stamps

Despite their benefits, cigarette tax stamps face several challenges in implementation:

- Rebound Effects on Consumer Behavior: As cigarette prices rise due to increased taxes, some consumers may turn to low-tax or untaxed cigarettes as substitutes, reducing the effectiveness of tax policies.

4. Future Reforms and Developments

In the future, the role of cigarette tax stamps is likely to become even more significant. With the global anti-smoking movement gaining momentum, the design and function of tax stamps may evolve to focus more on enhancing anti-counterfeiting technologies to address the growing issue of counterfeit goods.

Additionally, countries may introduce differentiated taxation policies based on the harm level of different tobacco products. For example, new tobacco products like e-cigarettes may gradually be included in tax stamp regulations, expanding the scope to cover a wider range of tobacco-related products.

5. Conclusion

Cigarette tax stamps are not only a tool for managing tobacco taxes but also an integral part of national public health policies. As awareness of the harm caused by tobacco continues to grow, tax stamp systems will continue to be refined to promote the legal and compliant development of the tobacco industry. By continuously improving tax policies and strengthening regulation, we can achieve the ultimate goal of reducing smoking rates and mitigating the harm caused by tobacco.

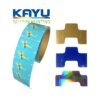

Customized Tax Label Digital tax stamp

Anti-counterfeiting labels Tax Stamp alcohol tax stickers, tobacco tax stickers label

Stamp Label Sticker custom stickers label printing

Duty-paid label Tax-free label Tax-free label Wine label Cigarette sticker

E-mail: hkkayu@hkkayu.com

Relevant certificates and authorizations are required for printing

Custom Tax Stamp Manufacturer – Excise and Duty Stamps

Custom Tax Stamps as A Form of Regulation Compliance

At HKKAYU, we design and manufacture custom tax stamps, ensuring they remain within required quality and security specifications. Our tax stamps serve as a legal compliance mechanism for taxation requirements on controlled goods such as tobacco and alcohol. Moreover, we assist our clients in marketing their products by counteracting and controlling product misuse such as counterfeiting and unauthorized selling.

Complete Solutions for Excise Stamps

We have a portfolio of excise and customs stamps for your business which has been customized for compliance or operational needs. Each stamp bears secure features like serial numbering, holograms, QR codes alongside non-tampering materials. Hence, your goods are traceable and verifiable all through the supply chain. You may also alter the emblem so that it represents jurisdiction and brand identity.